Transitioning from short stay tourism to the mid-term housing market for a sustainable rental income

Transitioning from short stay tourism to the mid-term housing market for a sustainable rental income

The short-term rental market, with guests staying anywhere from a few days to a few weeks, has enjoyed an explosion in demand followed by an influx of investors over the last few years. Unfortunately, the COVID-19 outbreak has caused any excitement for a good summer season to evaporate. At the same time longer term projections for the short-stay market are also under threat by the implementation of restrictive legislation in many of the most popular destinations around the world. Instead, investors might be better off setting their sights on the mid-term rental market, exchanging high, but volatile income for sustainable, predictable cash flows that enable growth.

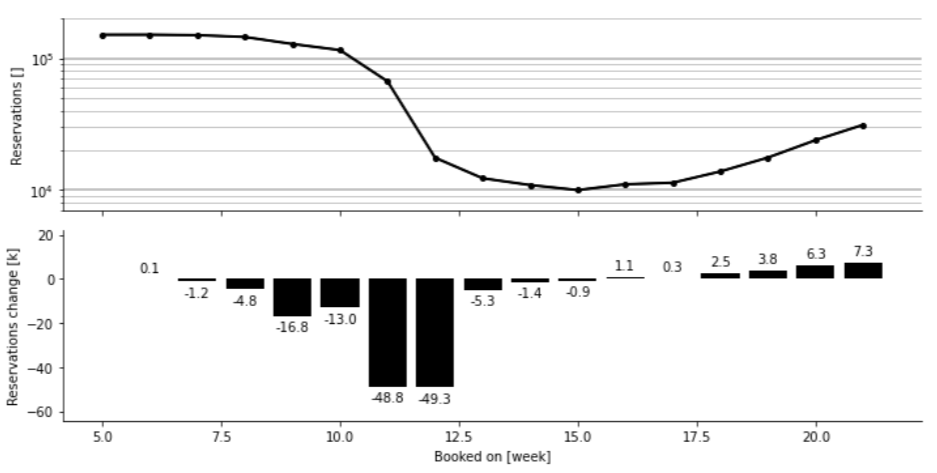

When demand plummets overnight

The world had seen travel restrictions before, without any real long-term consequences. But then, countries like Italy started quarantining entire regions of the country and major companies started sending their workforce to work from home. For short-term accommodation providers, what was supposed to be a record summer full of travelers, tourists and weekend wanderers, turned into a market that ground to a halt almost completely over the weekend. Google Trends shows us that the interest in the world’s biggest bed-and-breakfast site decreased by over 75% in a matter of weeks. Worst of all, nobody really knows when the Corona crisis will be over or, perhaps more importantly, if things will even go back to the way they were before the virus?

“Google Trends shows us that the interest in the world’s biggest bed-and-breakfast site decreased by over 75% in a matter of weeks.”

“Nobody knows when the Corona Crisis will be over, nor if things will even go back to normal.”

When the rules of the game change while playing

At the same time, the short-term rental market is facing local threats that could impact the long-term viability of the global short stay market. Where acquiring and renovating properties was well worth the investment due to virtually nonexistent short-term rental regulations and premium prices to meet the demand, this will no longer be the case in the near future. In many countries, the already volatile housing markets of popular cities were further disrupted by the arrival of a large number of short-term providers. As a result, governments and municipalities all across Europe have passed or are drafting legislation to regulate the short stay market. These measures range from requiring special permits, capping short stay rentals at a max of 60 days a year, setting up quotas for popular neighborhoods and even include contractual constraints. For many providers, this means a large chunk of their projected income is no longer guaranteed.

“Many short-term providers just like you are looking for an alternative.”

With both the long and short-term results of the market under pressure, it’s not strange that many short-term providers are looking for an alternative. Thankfully, there is no need to jump ship. Instead, a shift in strategy in order to meet the needs of your local housing market could mean a relatively painless solution.

Shifting gears

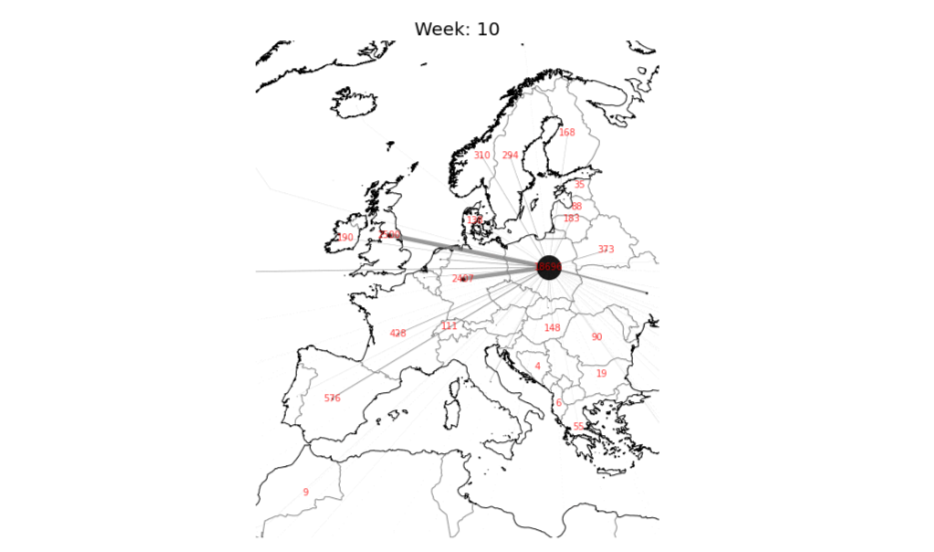

While demand for the international short stay market has collapsed, housing markets across Europe are still buckling under demand from locals, international students and highly educated expat workers. Rental prices have been steadily rising for years, but still the supply cannot meet all the demand.

While your target audience is different than before, they are still hungry for ready-to-go rooms, studios or apartments close to their work or studies. The hard-working tenants that will stay with you for anything from a semester to a year are also willing to pay extra for the services you already provide to the city hopping weekend crowd. International students or expats often arrive on Saturday and start work on Monday. This means they are happy to pay extra for the fully equipped kitchen, the weekly cleaning service, high speed internet and included Netflix account that allows them to simply unpack their bags and focus on settling in.

What’s different is that you’re exchanging weekend guests for longer term, contracted tenants. For you, this means less frequent mutations and stable long-term income through monthly payments. At the same time, you avoid the risk of being stuck with a tenant for years on end by focusing on the mid-term rental market. All in all, this keeps your business agile, able to respond to changes in demand and seasonality without your cash flow running dry over the weekend.

“… give yourself the stability to focus on the growth of your rental business.”

At the same time, these longer-term tenancies allow you to scope a more robust projection of your future rental income. You have plenty of time to find new tenants and you know exactly how much your home will earn you in the coming months. This gives you the stability to focus on the growth of your rental business and makes it easier to secure the additional funding to realize that growth. After all, your now stable rental income counts towards securing a loan for your next properties. Over time, your business will grow into something more and more passive and sustainable for the long term.

Finding a new home for your business

Even though your properties are ready for a transition, you are still entering a new rental market. You’ll be dealing with different legislation, new target audiences and the market’s own quirks and pitfalls. Where short stay platforms are king in getting your place booked for the weekend, you now need a different strategy to convince potential tenants to come live at your place for months on end.

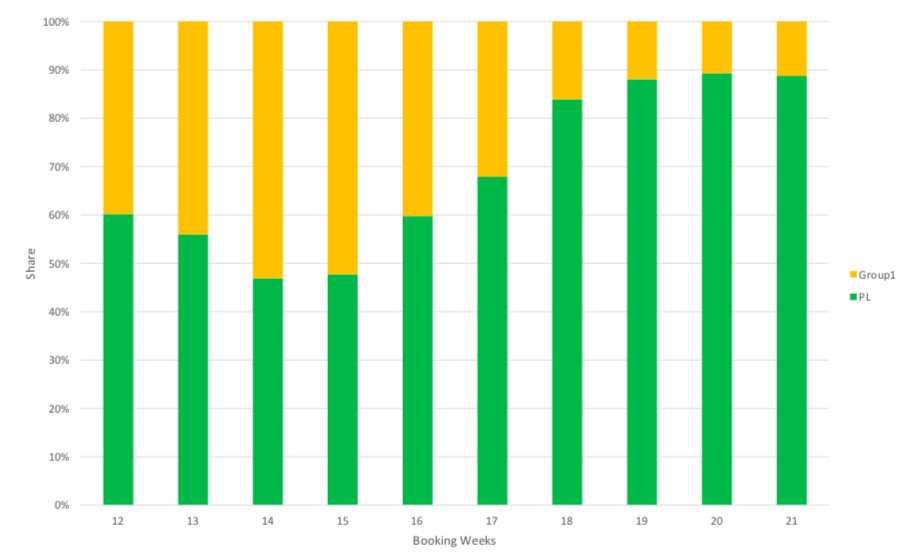

“Roughly 60% Tenants on HousingAnywhere book their stay for a period of 3-6 months.“

As a housing platform, HousingAnywhere has over a decade of experience in matching landlords with the right tenant time and time again. Roughly 60% Tenants on our platform book their stay for a period of 3-6 months. Before, guests might have booked blindly, but for longer term tenants, communication is now key. For example, tenants will reach out to you, introduce themselves and ask questions. Initially making it more time consuming than a blind booking but making it much easier to find the right match for your place. This might seem strange at first but getting to know a prospective tenant will save you time and effort in the long run by preventing friction, damage or rental arrears. Additionally, bookings now give you peace of mind for months on end, instead of having you hustle to get your accommodations booked every weekend.

Pricing your place is also a different ballgame, as you need to adapt to new kinds of seasonality and different pricing strategies based on location, quality, and property type. HousingAnywhere helps landlords navigate these changes, using data to predict the optimal pricing strategy in their neighborhood, using the RentRadar tool. The platform also includes a Rent Index data report so landlords are also kept up to date with the latest trends in the European market.

Booking.com Recovery Toolkit

Guest communication tools: why guest engagement is important?

Strategies for hotel revenue managers in COVID times: brace your business upfront! Part II

Strategies for hotel revenue managers in COVID times: brace your business upfront! Part I